12 July 2021 Douglas Newsome

Pre-investor Outreach / Targeting Investors

The first and the foremost step of the outreach process is to understand the investor’s needs, risk-taking capacity, tax status and values. Are your missions aligned?

Does the investor require significant handholding before/during/after an investment?

Does the investor have a “partnership mindset” with its active managers?

Since virtually no investor allocates to all asset classes, allocators need to see if at a high level, it is something they would even look at.

While some investors have quite broad mandates, others are solely focused on one or two strategies – say early stage venture or multi-family housing or L/S equity hedge funds or private credit, etc.

Don’t bring a hedge fund to a VC fund of funds – unless you are pitching the very high net worth owner of the VC FOF.

If you have a “new asset class” investment, you will have much more spade work and will need to work with investors that have a more open mindset.

Prior to or during the first call or meeting

Allocation Potential – When you speak with a potential investor, in their minds they will be thinking: “do we have sufficient room to allocate at this time? Do we have to sell/replace something? Can I spend time looking at your opportunity?”

There are several types of allocation scenarios – let me mention four important ones.

- Inventory Investment Consultants/platforms have curated lists of managers that they have vetted and approved for their clients. Their end-clients will then choose among the list. Ultimately, a few managers will typically garner an outsized portion of the commitments.

- Strategic Investment An allocator may be committing capital for reasons beyond typical risk/return/liquidity parameters. Cleantech/renewable energy, ESG and crypto are examples.

- Replacement Investment An allocator likes a sector/strategy/horse but would like to change the manager/jockey.

- Expansion Investment An allocator has either had success or believes there is an improving outlook and will look to add a manager within an asset class.

FIRST CALL / MEETING AND BEYOND

Investment [Manager] Diligence – the investor needs to process a lot of information to get to a “yes” – the following are seven questions (of many):

- Who are the People? who, what, where, when, why and how they do what they do?

- In raising capital, the team is more important than the track record. Period. Since “people are responsible for the results” spin-outs from brand names are easier to raise capital than geniuses without pedigree.

- What is the Opportunity? what people want goes in and out of fashion. Convert arbitrage was the rage for 15 yrs. Private credit was nowhere early on. Crypto was backwater until recently.

- What is your Investment Philosophy? An investment philosophy is a set of beliefs and principles that guide an investor's decision-making process. (Not a narrow set of rules or laws, but rather a set of guidelines and strategies that take into account one's goals, risk tolerance, time horizon, and expectations.)

- What is your Process? How does an investment get into the portfolio or out? Who has input? Who has the final say?

- Is this a Partnership? what is the alignment? Is it heads I win/tails you lose? As an aside: ETFs are not partnerships – they are low cost supplier agreements.

- Are your Fees in line with the current market? If a fund’s fees are not in line with the current market, some investors may not spend their time to even review the opportunity.

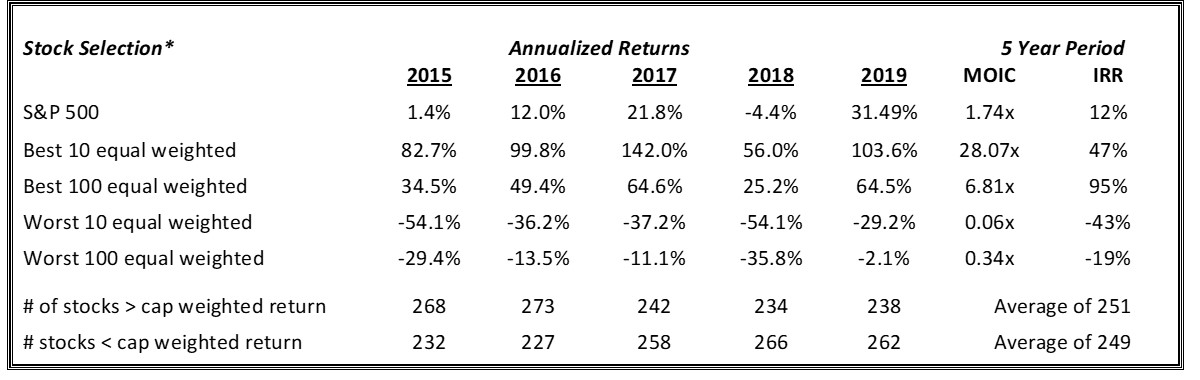

- Can we breakdown your historical results? Without getting into the why’s for these questions, just know that how people analyze historical track records ranges from very high level to meticulous measurements of the minutiae.

- Historical performance usually forms the guidelines for future benchmarking

GETTING SERIOUS

Investment Committee / Corner Office Eight Committee Process Questions (out of many):

- How close is your contact to the money?

- How often does the committee meet?

- Do they typically rubber stamp or do they turn down lots of investments?

- Are the committee members knowledgeable investors? Are they driven by political issues?

- Does the investment have broad support from the organization?

- Is it a new CIO? Is anyone using political capital ie. pushing extra hard to get the ok? Or, is this an investment from a long line of typical allocations?

- Does the allocation/investment conform to all policies?

- Does a consultant have to sign off?

Operational Due Diligence – This may be done prior to a committee or after. A small sample of the items which may be included within the scope of an ODD is outlined below:

- valuation techniques, and related processes/controls and disclosures

- business continuity and disaster recovery planning

- fraud risk and other irregularities

- background and reference checks of the principals

- liquidity mechanisms (“lock-ins” and “gates”)

- security of assets – which is obviously a focus with crypto currencies

- full legal review

- review of the controls and processes of the main outsourced service providers

Closing Thought

Client Support / Service – stay in front. This is relationship building for your next opportunity.

Best wishes to all.

Douglas Newsome, CFA

Managing Director, Director of Research

Perkins Fund Marketing LLC